iATS © – integrated ATM Transactions Settlement system is a business application solution aimed at the post-operation process presented in the financial institution with an ATM’s network.

It is a pleasure for us to introducing you to our company and our innovative product iATS System © tool, which is built for improving the actual and possibly manual post-operation business process, the business process after the operation of any ATM Network that belongs to a Financial Institution/Bank. This technological product was a result of the founder previous experience at ATM Sector (ex: Servibanca and the Colombian state former bank BCH) as analyst and programmer of the founder about 20 years ago. And it was developed since 2016.

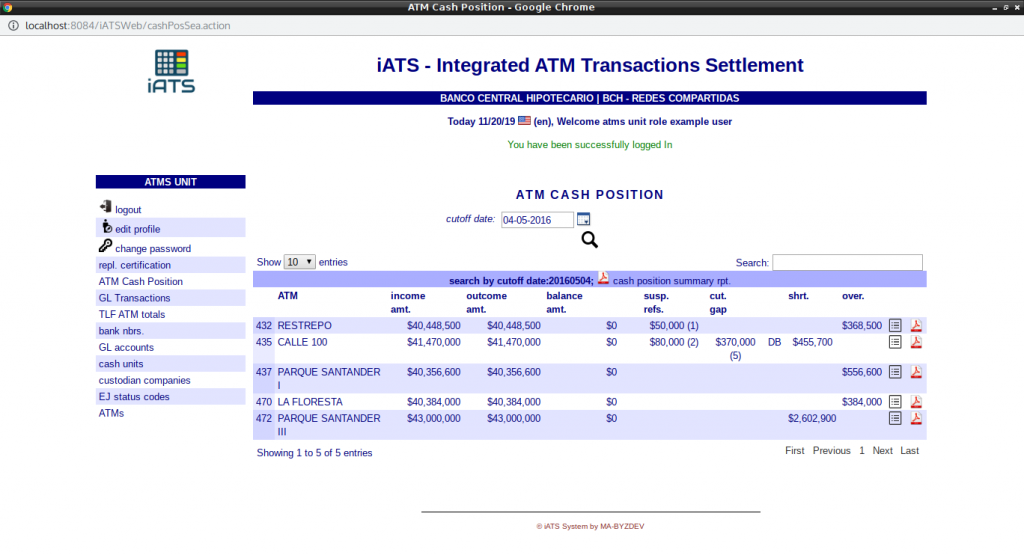

Our company has developed the iATS © tool, which is a business application based on the web, in order to produce an integrated cash position state for each ATM, and allows us to look forward to the origin of the differences of the amount, in an easy way.

In addition, all customer complaints and disputes on ATM transactions will be solved in a fast and efficient way, because all related data is available to the business process analyst, in consequence, the financial institution will offer a good service to their customers.

The main requirement for this tool is that every ATM in your network must have installed the electronic journal EJ facility, which it is very common at this XXI century, and this information must be processed and stored in an ATM Server.

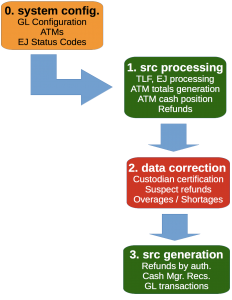

The iATS – integrated transactions ATM Settlement, used by the any Electronic Banking Business Unit in a post-operation business process context, is semi-batch, which consists of three main stages:

- source processing from external engaged systems like the switch (Transactions Log File TLF) and the ATM server (Electronic Journal EJ source file),

- data correction, in order to adjust the system information if ATM cash position is unbalanced (cf. cash position report), or there are some suspect refunds (cf. suspect refunds report).

- source generation to other external engaged systems like the switch (on expects that switch processes the refunds), to the cash manager software, and to the Financial Institution’s Accounting system.

The following diagram shows us the sequence of these three stages:

(*) The stage 0 is a requirement that must be met because every new ATM must be attached to a cash a unit, and every cash unit and concept code combination must be configured with proper debit and credit GL account in order to perform daily GL transactions generation.

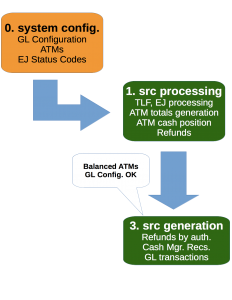

In the case of balanced ATM cash position records and/or suspect refunds to be solved, and finally all replenishment information are well supplied by branches and vault custodian, all of this post-operation process could be entirely batch, thus, it is not necessary user intervention and this is the best situation.

Stage 2 or Data Correction must take place after reviewing cash position report, including the printed version,

the suspect refunds report,

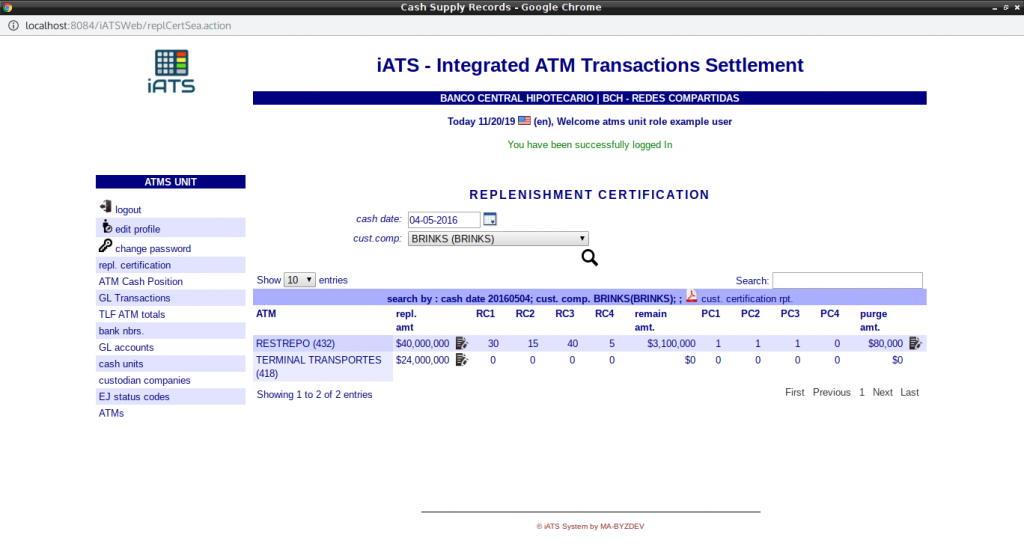

and finally, the replenishment certification supplied by the vault custodian companies, who keep and transport cash from/to ATMs.

If there were any suspect refund, the ATM at this cycle is going to be unbalanced. Thus, one has to solve this kind of refund checking against with available money at purge cassette, after the cutoff event.

After, one has to review the replenishment certification from cash unit (branch/vault custodian) associated with every ATM, against data uploaded to our system, and correct it.

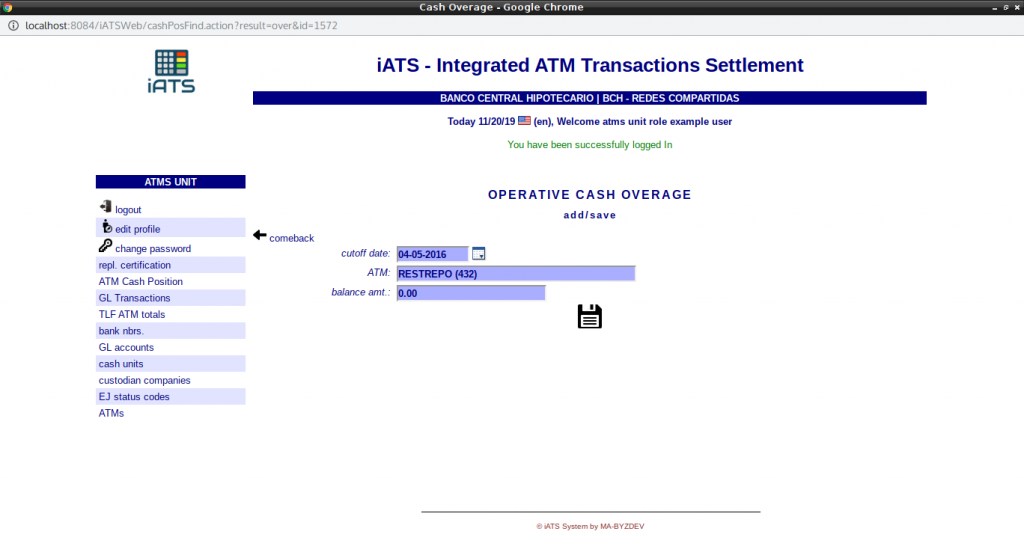

If an unbalanced state prevails, the last resource will register any overage, in order to balance the ATM cash position.

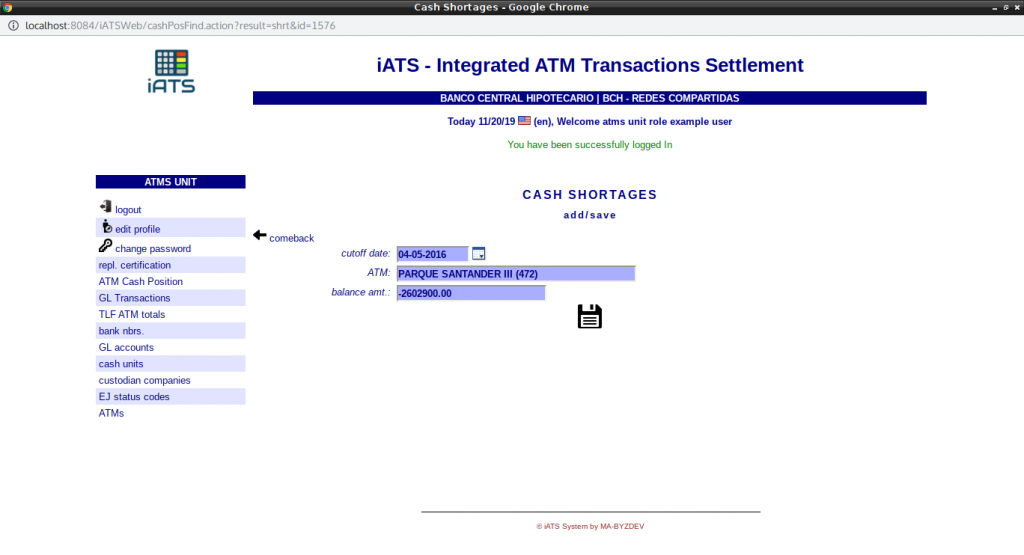

or shortage,

Therefore, the data for other external systems such as GL System, Switch, and Cash Manager, could be generated, and the whole iATS system can be cut off also.

(**) The stage 3 source generation if and only if must be launched if every new ATM has been attached to a cash a unit, and every cash unit and concept code combination must be configured with proper debit and credit GL account in order to perform daily GL transactions generation.

Of course, one can review the GL transactions report for any business date.